By MOAA Staff

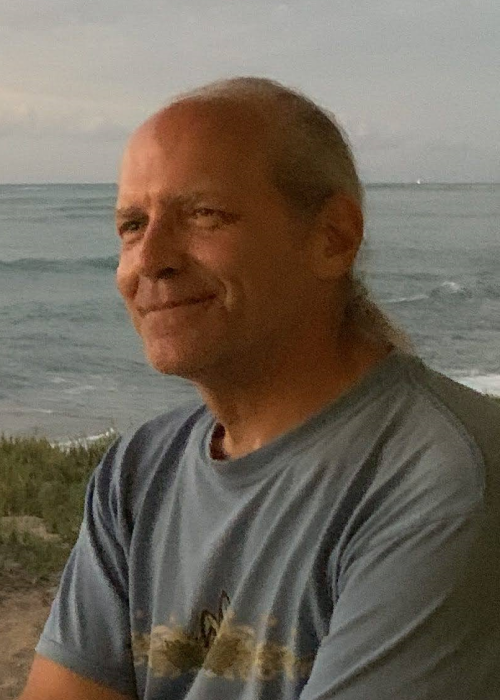

Doug Nordman and his wife did the math and determined they were financially independent after he’d served 17 years in the Navy. Nordman, pictured, retired as a lieutenant commander at the 20-year-mark in 2002, at 41 years old, and has spent the last few decades surfing, writing, and assisting others in finding their own path to an earlier-than-expected retirement.

Doug Nordman and his wife did the math and determined they were financially independent after he’d served 17 years in the Navy. Nordman, pictured, retired as a lieutenant commander at the 20-year-mark in 2002, at 41 years old, and has spent the last few decades surfing, writing, and assisting others in finding their own path to an earlier-than-expected retirement.

The retired submariner will take part in a free Oct. 8 MOAA webinar designed to do just that, helping attendees navigate their financial situations, understand when they have enough money to achieve personal goals, and establish safe withdrawal rates that can make their investments last.

[REGISTER TODAY: Oct. 8 MOAA Webinar With Doug Nordman]

Here’s more from Nordman:

Safe Withdrawal Rate

“Mathematically, you’re financially independent at the 4% Safe Withdrawal Rate (SWR) when your assets reach 25 times the amount of your net annual spending,” Nordman told MOAA. “You start your first year of financial independence by withdrawing 4% of the value of your assets, and every year afterward you raise your annual withdrawal by the inflation rate. The computer simulations of the 4% SWR show a very high probability (with statistical confidence) for your investments to survive at least 30 years.”

For many considering early retirement, “statistical confidence” isn’t enough.

“Humans don’t focus on financial success rates,” Nordman said. “Our emotions are optimized to obsess over the failures.”

[FROM THE ARCHIVES: How Much Is Enough to Retire?]

Webinar attendees will receive a detailed breakdown of the SWR process, he said, with “ways to shift your mindset from scarcity to abundance.” Some examples of reassurance:

- The 4% rule does not include Social Security income or other annuities, like VA disability compensation and pensions. “A military family’s investments will almost certainly make it to the minimum age for Social Security,” Nordman said, “and then that inflation-adjusted annuity will augment your lifestyle through future economic turmoil. For most Americans, Social Security is all the longevity insurance you’ll need to support the rest of your investments.”

- The 4% rule algorithm assumes your spending will rise with inflation, but that’s not always as cut-and-dried. “Some of our spending is lumpy,” Nordman said. “Our asset allocation and a little variable spending can extend our investment portfolio’s survival.”

- Small changes can correct for lower-than-expected investment returns, Nordman said. “You don’t even need to consider variable spending until after the first year of a recession. You might spend more of your cash or bonds to let your stocks recover. You could postpone big expenses like a fantasy vacation or a replacement vehicle – you may be worried, but you won’t face deprivation.”

‘Just One More Year’

The scarcity mindset can lead to a common rationalization: If I work another year (or two, or three …), it will be enough to drop my investment withdrawal rate to a more reasonable level.

[RELATED: From Military Officer Magazine: Polish Your Estate Plan]

Nordman warned against “Just One More Year Syndrome,” stressing that while retirees should continue work if they find it rewarding, but “each additional year of work only guarantees that you’ll die with more money.”

“You traded life energy (which is limited) for money that you did not need. Was it worth it?” he asked. “More importantly, will working one more year ease your scarcity mindset and help you sleep better at night? What about more workplace stress and less time with your family? How will you recover from burnout and plan the next stage of your life?”

Learn more about Nordman’s background, books, and blog posts at this link. And register today for MOAA’s upcoming webinar to find your path to financial independence.

Download The MOAA Investor’s Manual

Download The MOAA Investor’s Manual

This guide will help you better understand and manage your investments. It's available exclusively to PREMIUM and LIFE Members, who also may speak with MOAA benefits and financial counselors for further assistance.

Not a member? See below to learn more about joining MOAA or upgrading your membership.